A Comprehensive Guide to Real World Asset Tokenization: Part 1 & 2

Multi-Part Premium Research Series on RWAT

Over the next few weeks, we’ll be rolling out our latest research on RWA projects in segments, each spotlighting exciting initiatives. We’ll cover specific projects, some of which are available on exchanges. In today’s email, Part 1 and Part 2 explore the Trillion Dollar Opportunity and provide an overview of the Current State of Tokenization. The next email will wrap up Part 2 and kick off Part 3, continuing until we’ve shared all of our latest findings.

As blockchain technology continues to evolve and extend its influence, we are now seeing the rapid tokenization of real-world assets, often referred to as "The Great Tokenization." This movement is reshaping the ownership, trading, and value generation of assets worth hundreds of trillions of dollars.

Imagine owning a piece of the airspace above Manhattan and trading it like a stock. Picture yourself investing in a Picasso masterpiece for just $50, buying a government bond with a tap on your smartphone, or acquiring 30 minutes of your favorite crypto influencer’s time—an asset that’s tradable and can fluctuate in value. These aren’t far-fetched future scenarios; they’re real developments happening right now.

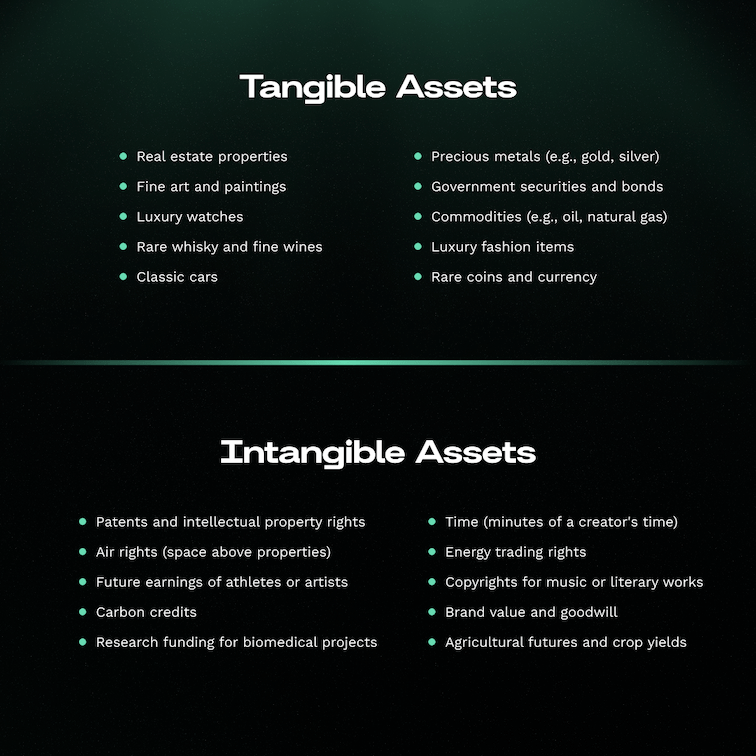

The tokenization of real-world assets is breaking down barriers to markets that were once out of reach for most investors. Real estate ownership is being divided into smaller shares, enabling investors to buy stakes in properties worldwide for less than the cost of a nice meal. Government securities, which used to be accessible only to large institutional investors, are now appearing on the blockchain, opening up these investment opportunities to a broader audience. Whether it's tokenized energy, time, airspace, intellectual property, mortgages, car leases, or carbon credits—if it’s an asset, tangible or intangible, someone is working on tokenizing it right now.

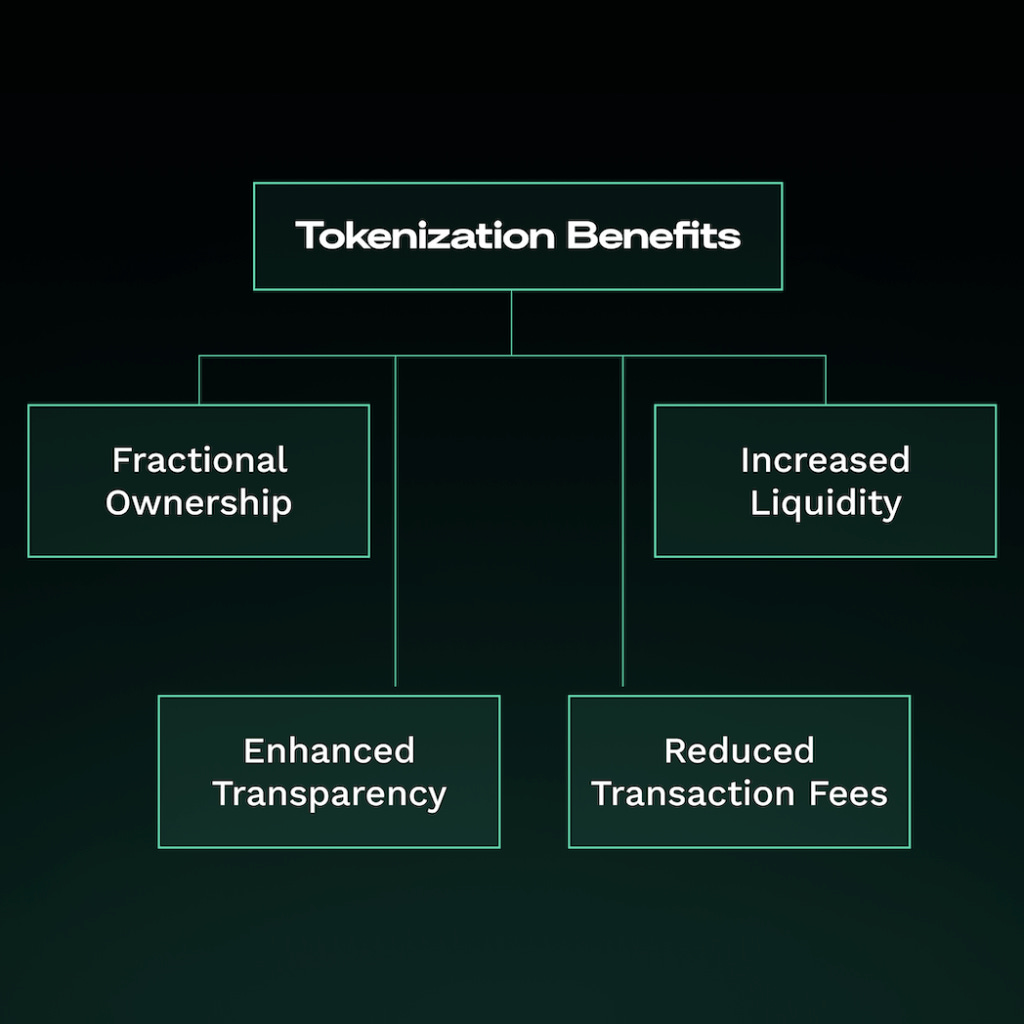

For those new to the concept, tokenization involves converting rights to an asset—whether physical or digital, tangible or intangible—into a digital token on a blockchain. This seemingly straightforward idea is unlocking a world of possibilities thanks to four key advantages:

- Increased liquidity

- Fractional ownership

- Enhanced transparency

- Reduced transaction costs

The potential impact is vast and varied. In scientific research, tokenizing intellectual property rights is transforming the funding of biomedical studies. The fine spirits market is seeing a revival of authenticity and accessibility. Even precious metals like gold are being digitized, allowing investors to trade fractions of gold bars without ever handling the physical asset.

From real estate to rare whiskey, carbon credits to future earnings, the possibilities for tokenization seem limitless. It’s not just changing the way we invest but also redefining our understanding of ownership and value.

In this report, we’ll explore the world of tokenization and its profound implications. We’ll dive into unique projects, examine the technologies driving this revolution, and look ahead to the future of asset ownership and trading. Join us as we uncover how "The Great Tokenization" is reshaping the global financial landscape like never before.

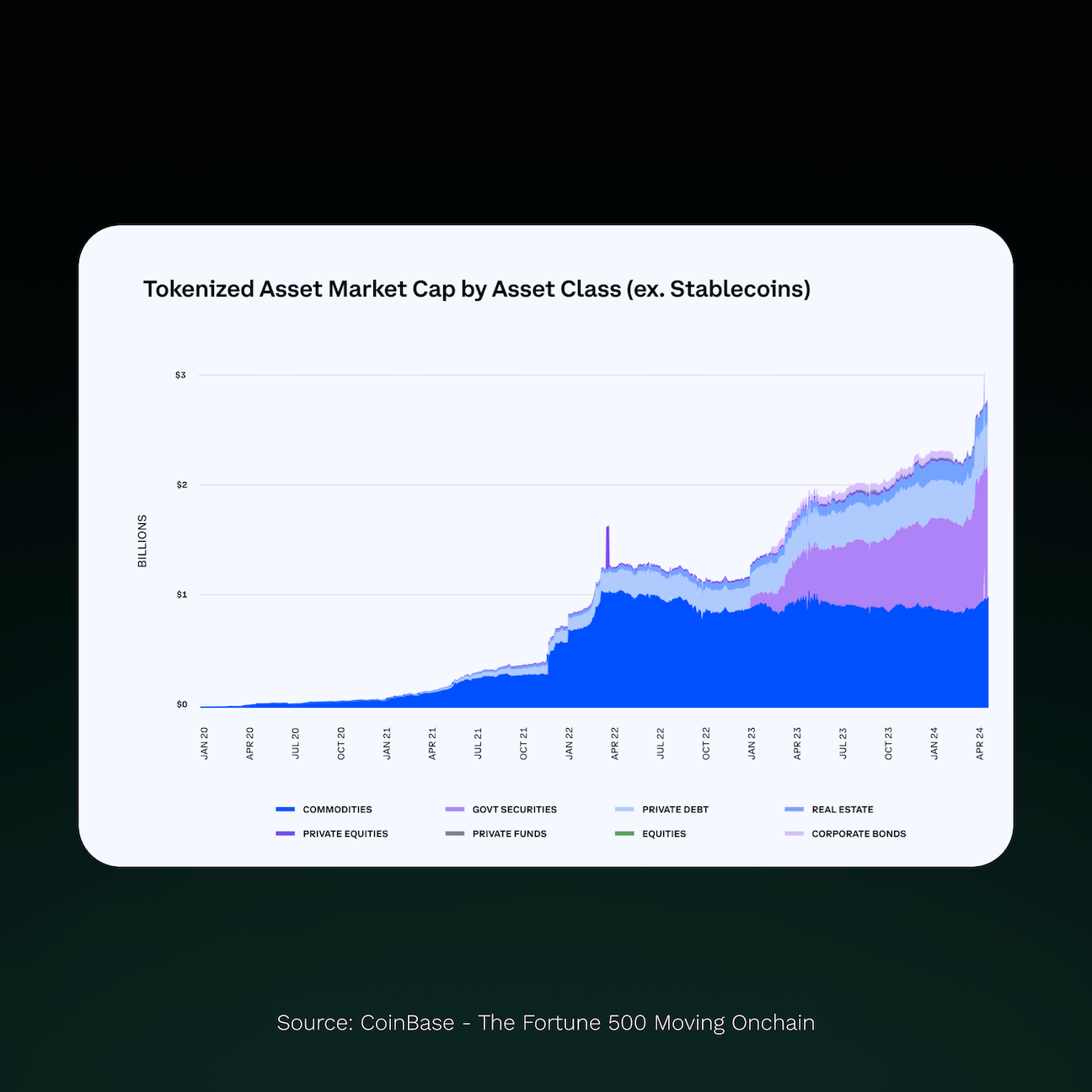

The potential for asset tokenization is immense, with estimates suggesting that hundreds of trillions of dollars worth of assets could be digitized. As of now, around $185 billion (including stablecoins) has already been tokenized, according to RWA.xyz. Naturally, this raises the question: what exactly is tokenization, and how can individuals take advantage of this transformative trend?

Part 1

The Great Tokenization: Trillion Dollar Opportunity

Why Blockchain? The Foundation of Tokenization

Cryptocurrency has often been viewed as a technology in search of a problem, but when it comes to asset tokenization, the benefits are evident—it’s simply a better solution than existing methods. So, why is blockchain essential to this transformation? Traditional asset management has long been beset by significant challenges that frustrate investors, issuers, and regulators. Issues like a lack of transparency in private markets can lead to mispricing and higher risks, while illiquidity in high-value assets, such as real estate or fine art, locks up capital for long periods. High barriers to entry exclude smaller investors from diversification opportunities, and inefficient processes involving multiple intermediaries lead to slow, costly, and error-prone transactions. Furthermore, limited trading hours make it difficult to react swiftly to global events, and opaque markets leave room for fraud and manipulation.

Blockchain technology addresses these long-standing issues. It offers a level of transparency and security that was previously unattainable, with all transactions recorded on a public, immutable ledger accessible to all participants. This openness fosters trust and greatly reduces the risk of fraud, tackling the lack of clarity that has long plagued many asset markets.

The most revolutionary aspect of blockchain-based assets is their enhanced tradability. The technology enables 24/7 trading, breaking free from the constraints of time zones and reducing the need for intermediaries. This continuous market activity revitalizes traditionally illiquid assets. Imagine trading a fraction of a real estate property as easily as a stock—that’s the power of tokenization.

But the advantages extend beyond transparency and tradability. Blockchain's programmability, through smart contracts, unlocks new possibilities for asset management and governance. Processes like dividend distributions, voting rights, and other complex operations can be automated, increasing efficiency and creating fresh avenues for investor engagement. This directly addresses the cumbersome nature of handling corporate actions in traditional systems.

Together, these features are democratizing investment opportunities like never before. High-value assets that were once accessible only to the wealthy can now be divided into smaller, more affordable units. This fractional ownership model is opening up access to a wide range of assets—from fine art to commercial real estate—enabling more people to build diversified portfolios and breaking down the high barriers to entry that have historically kept smaller investors out.

Understanding the Advantages to Tokenization

Tokenization involves creating a digital representation of an asset on a blockchain, which could range from real estate and artwork to intangible assets like intellectual property rights. Each token symbolizes a share of ownership in the underlying asset, enabling more granular and flexible ownership arrangements.

Fractional Ownership: Tokenization allows assets to be divided into smaller, more affordable units, making investments more accessible to a broader audience. For instance, instead of needing a large sum to invest in high-value real estate, investors can buy tokens that represent a fractional share of the property.

Improved Transparency: Blockchain technology creates an unchangeable record of all transactions, increasing transparency. This can help reduce fraud, build trust, and simplify auditing.

Lower Transaction Costs: By streamlining processes and eliminating intermediaries, tokenization can significantly cut down the costs associated with asset transfers and management.

Greater Liquidity: Tokenization can transform traditionally illiquid assets into easily tradeable digital tokens, potentially opening up new, more liquid markets for a variety of assets.

Tangible vs. Intangible Assets

An intriguing development is the tokenization of intangible assets—those that have traditionally been difficult to convert into liquid, tradable forms. With tokenization, items like claims on someone's time or intellectual property rights can become liquid assets that owners can easily buy and sell.

- Tangible Assets: Physical items with concrete, measurable value.

- Intangible Assets: Non-physical items that still possess significant value.

The tokenization of tangible assets like real estate and fine art is impressive, but what really gets us excited is the opportunity to bring intangible assets onto the blockchain. These are assets that historically lacked effective value exchange mechanisms. Now, we're seeing intellectual property rights, future earnings, carbon credits, and even personal time being tokenized, paving the way for entirely new markets and fresh perspectives on value.

Just think about it: you could trade the future earnings of a promising artist, invest in a patent for an innovative medical breakthrough, or purchase a stake in the carbon offset potential of a rainforest. These intangible assets, once challenging to quantify and trade, are becoming accessible and liquid thanks to tokenization.

As we dive deeper into the age of The Great Tokenization, we can look forward to an increasing array of both tangible and intangible assets being tokenized. This evolution is set to foster more efficient and liquid markets across numerous industries, merging the realms of physical and digital asset ownership.

Part 2

The Current State of Tokenization

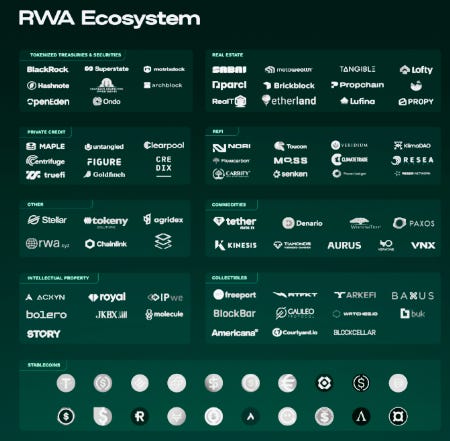

We decided to create this report because our research revealed a much higher level of activity in the RWA tokenization space than many people realize. It’s an exciting development, and we want to shine a spotlight on this movement and highlight the individual projects within it.

Recent projections indicate a potential explosion in the tokenization market. Estimates suggest that by 2030, the market for tokenized assets could soar to anywhere between $2 trillion and $10.9 trillion, depending on which predictions you find most credible. Among these, real estate, debt instruments, and investment funds are expected to be the frontrunners, solidifying their position as the top three tokenized asset classes.

You’ve reached the end of the free content. Want the rest of the article? Subscribe now, and you’ll receive a wealth of exclusive content straight to your inbox! In this series of articles we mention specific projects that we are investing in at the time of writing.