A Comprehensive Guide to Real World Asset Tokenization: Infrastructure

Tokenized RWA Sector to hit $10 trillion by 2030

Over the next few weeks, we’ll be rolling out our latest research on RWA projects in segments, each spotlighting exciting initiatives. We’ll cover specific projects, some of which are available on exchanges.

In today's email, we will finish off talking about some Infrastructure examples where we’ll highlight various infrastructure projects.

Part 2: Current State of Tokenization topics:

Infrastructure

Government Securities

Private Credit

Stablecoins

Commodities

Real Estate

Intellectual Property

Luxury Collectibles

Carbon Credits

Misc. Niche Mentions

Part 3: The Future of Tokenized Assets

2030 Market Size Predictions

Capitalizing on The Great Tokenization

If you haven’t read Part 1 and the start of Part 2, start here:

A Comprehensive Guide to Real World Asset Tokenization: Part 1 & 2

Over the next few weeks, we’ll be rolling out our latest research on RWA projects in segments, each spotlighting exciting initiatives. We’ll cover specific projects, some of which are available on exchanges. In today’s email, Part 1 and Part 2 explore the Trillion Dollar Opportunity and provide an overview of the Current State of Tokenization. The next email will wrap up Part 2 and kick off Part 3, continuing until we’ve shared all of our latest findings.

Infrastructure Examples

Let’s look at some of the infrastructure projects that are specifically focused on the RWA space.

Stellar Foundation

Since its launch in 2014, Stellar has evolved into a blockchain network that specializes in efficient cross-border transactions and asset tokenization. With over 8 million accounts and a robust infrastructure for real-world assets, Stellar prioritizes transaction speed and low costs, averaging just $0.000065 per transaction. In the first quarter of 2024 alone, the network facilitated 460 million transactions.

Stellar’s capabilities in tokenizing and managing real-world assets have attracted collaborations with major financial institutions. Partners like MoneyGram and Circle use Stellar for cross-border payments, while Franklin Templeton has introduced its BENJI token and a money market fund on the platform. Moreover, WisdomTree has issued 13 regulated funds, a digital gold token, and a digital dollar on Stellar, all compliant with U.S. regulations, with assets totaling around $23 million. The Stellar ecosystem continues to expand, with over $533 million in total assets and $1.6 billion in RWA payment volume, showcasing its growing role in bridging traditional finance and blockchain.

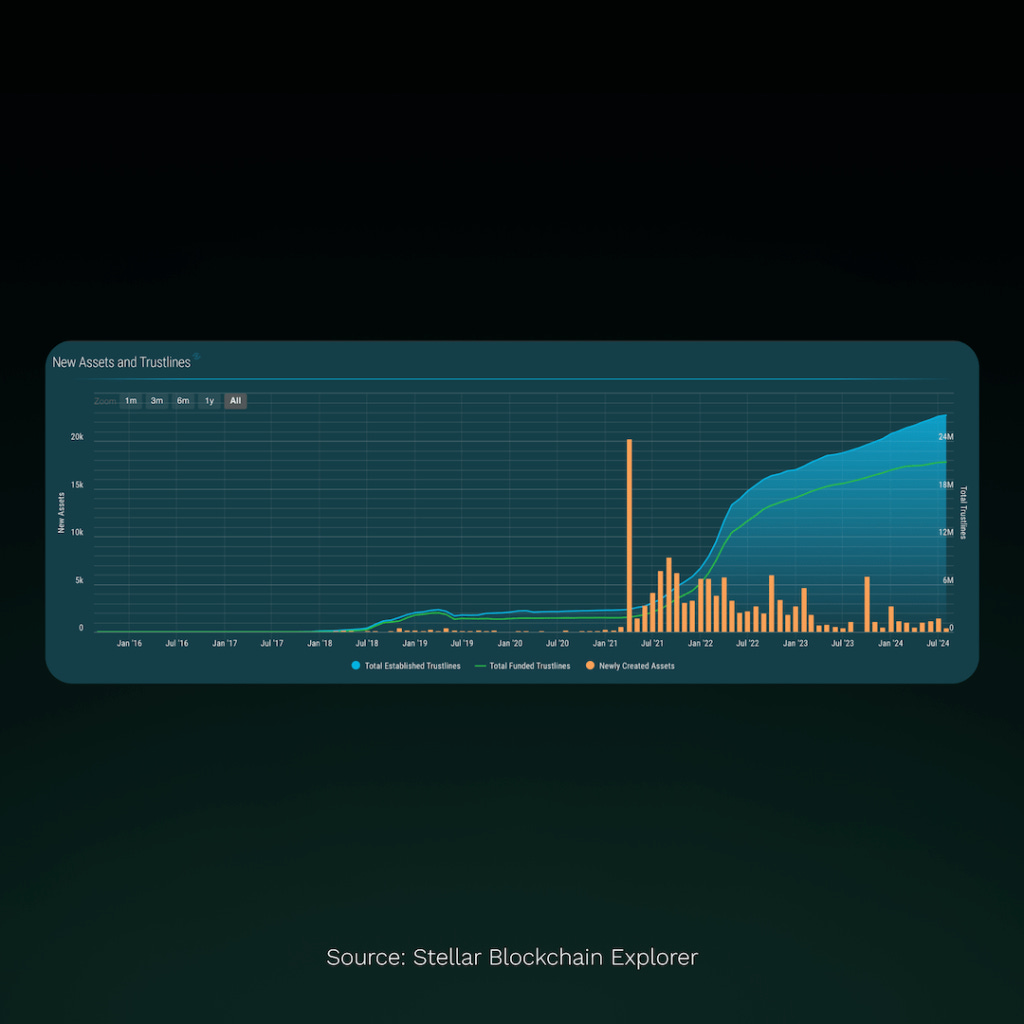

A standout feature of Stellar’s architecture is its use of trustlines, which act as connections between accounts to enable the holding and transacting of specific assets. To receive any asset other than Stellar’s native XLM, an account must first establish a trustline with the asset’s issuing account. This setup allows the Stellar network to support a diverse range of assets while giving users control over the assets they engage with. As illustrated in the chart above, Stellar’s ecosystem has seen significant growth since mid-2020, with total established and funded trustlines surpassing 20 million by 2024. The periodic spikes in newly created assets indicate waves of new projects or token issuances joining the network, signaling increased adoption and asset diversity.

Projects are drawn to Stellar for its robust asset tokenization infrastructure and the potential to innovate traditional financial products. An example is the Franklin OnChain U.S. Government Money Fund, which showcases the platform’s ability to make financial markets more accessible, aligning with Stellar’s mission of creating a more inclusive financial system—a priority emphasized by Denelle Dixon, CEO and Executive Director of the Stellar Development Foundation.

Although Stellar has supported basic smart contract functionalities since its inception, the March 2024 launch of Soroban marks a significant upgrade. This advanced smart contracts platform opens the door for more complex decentralized applications on Stellar, addressing previous limitations that restricted smart contracts to simple functions like multi-signature transactions and atomic swaps. Soroban introduces enhancements such as lower transaction fees, increased scalability, and built-in contracts, positioning Stellar to better compete in the smart contract arena and potentially develop a more robust DeFi ecosystem.

To encourage Soroban’s adoption, the Stellar Development Foundation has allocated $100 million to support projects building on the platform. This investment underscores Stellar’s commitment to expanding its smart contract capabilities and incentivizes developers to explore its network. As Stellar continues to evolve, it stands poised to play a larger role in the growth of tokenized assets and decentralized finance applications.

We’re proud of all we’ve built with our ecosystem partners regarding payments and RWA capabilities. It’s only by merging those capabilities, real world assets and real world payment channels that we can truly enable financial equality and wealth preservation in much needed regions and demographics across the globe.”

Rob Durscki,

Senior Director of RWA Tokenization at Stellar Foundation

re.al

Launched in May 2024, re.al is an EVM-compatible Layer 2 solution specifically built for real-world assets (RWAs) and decentralized finance (DeFi). Leveraging Arbitrum Orbit technology, the platform aims to create a permissionless environment for tokenizing and trading RWAs, addressing some of the longstanding challenges in traditional financial markets.

You’ve reached the end of the free content. Want the rest of the article? Subscribe now, and you’ll receive a wealth of exclusive content straight to your inbox! In this series of articles we mention specific projects that we are investing in at the time of writing.